2016/09/20 Commentary: FOMC Won’t Hike (late)

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY: Tuesday, September 20, 2016

FOMC Won’t Hike

This may seem to merely confirm what has become a consensus view. As of this morning 91% of market participants have come around to feeling there is no basis for FOMC to hike rates Wednesday afternoon. Yet this sentiment was not nearly as strong into and immediately after the Fed’s Jackson Hole Policy Symposium ‘hawk-fest’ three-and-a-half weeks ago. Due to stronger US data prior to Jackson Hole there was a belief by the ‘Street’ that the outpouring of hawkish indications from many Fed governors into, at and after the symposium might indicate the chance for a September rate hike was very good. Über-hawk Vice Chairman Stanley Fischer was back to suggesting there could still be two hikes in 2016, and Eric Rosengren could not resist resurrecting the specious cautionary drivel that things might get so strong it would be risky for the Fed to NOT hike in September.

This may seem to merely confirm what has become a consensus view. As of this morning 91% of market participants have come around to feeling there is no basis for FOMC to hike rates Wednesday afternoon. Yet this sentiment was not nearly as strong into and immediately after the Fed’s Jackson Hole Policy Symposium ‘hawk-fest’ three-and-a-half weeks ago. Due to stronger US data prior to Jackson Hole there was a belief by the ‘Street’ that the outpouring of hawkish indications from many Fed governors into, at and after the symposium might indicate the chance for a September rate hike was very good. Über-hawk Vice Chairman Stanley Fischer was back to suggesting there could still be two hikes in 2016, and Eric Rosengren could not resist resurrecting the specious cautionary drivel that things might get so strong it would be risky for the Fed to NOT hike in September.

As we noted again (this has been going on for well over a year now) in our September 7th Goldie’s Back post, “First there was a spate of somewhat improved data. That led to the predictably more hawkish Fed minions’ opinions at the Jackson Hole Policy Symposium two weeks ago, and in other venues. Yet, key data points in the wake of all that weakened enough to once again cast doubt on the Fed’s ability to raise rates. It is reminiscent of Ronald Reagan’s quip in his 1980 debate with Jimmy Carter (after Carter cited some oft-repeated social statistics)…

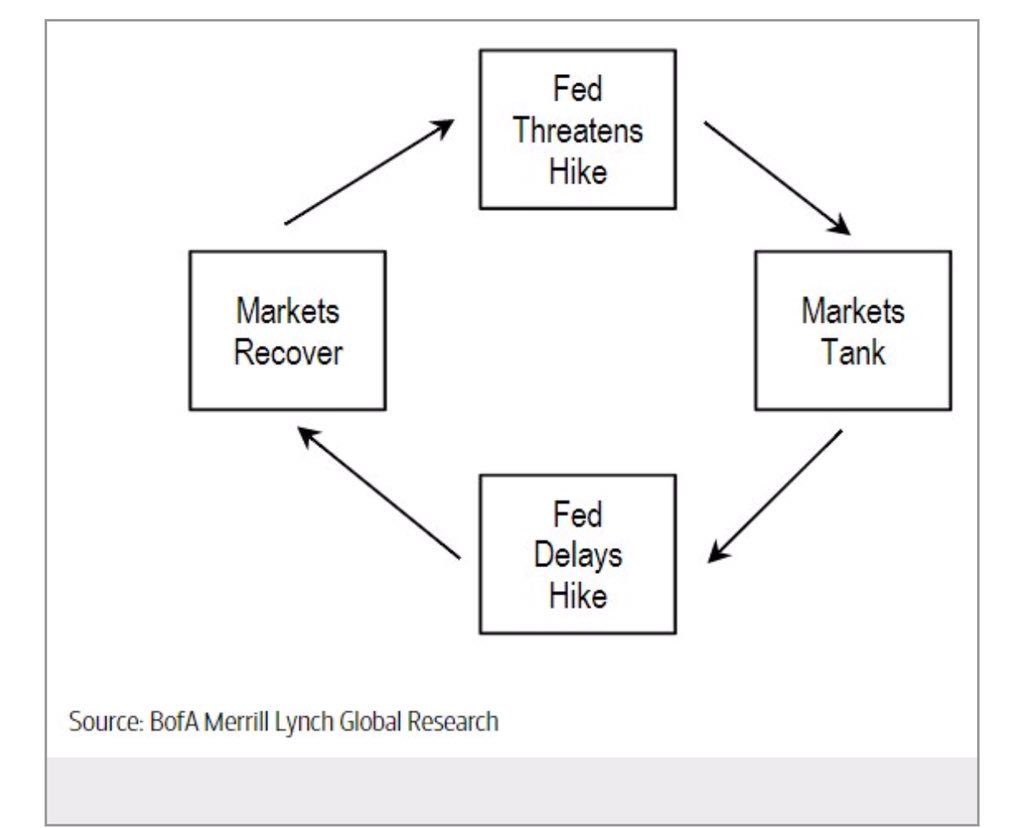

“There you go again.” And here was the Fed once again pushing the ‘normalcy bias’ on the improved economy needing further rate hikes, and being wrong-footed once again by the subsequent weaker data. This has been a regular cycle since the FOMC raised rates last December, and predicted there would be four more in 2016.” While we do not normally like to quote ourselves, it seems it is back to every bit of a “bad news is good news” psychology. That will likely see the equities able to rally once again if the Fed does not actually hike. That is likely a good reason the govvies will also rally after not managing to do so on the recent serial weak data (likely out of respect for the Fed.) Thanks to BofA Merrill Lynch Global Research for the wonderfully straightforward cycle graphic above.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: Back on the evening of December 8th we posted our major Extended Perspective Commentary. That reviews a broad array of factors to consider Will 2016 be 2007 Redux? For many who believe that the US economy is really strengthening and can once again lead the rest of the world to more extensive recoveries, this may seem a bit odd.

Yet there are combined factors from many areas we have been focused on since the early part of last year which are less than constructive for the global economy and equity markets. We suggest a read if you have not done so already.

We pointed out in December in the face of another likely Santa Claus Rally this was not an actionable view during the year-end equities rally. Yet it was (and remains) important background to utilize into 2016. This is much like our major late 2006 perspective on Smooth Rebalancing? …or… The Crash of ‘07? In that instance the economic factors built up, but the actual crash was deferred into 2008. It is starting to feel this one may be deferred as well.

▪ So once again we have a glaring example of the Fed’s rampant ‘normalcy bias’ getting in the way of its ability to project a well-informed view. While it remains the premier global central bank in terms of both broad influence and its impact on the world’s most important economy (more on that below), there is little doubt that these repeated missteps have robbed it of a good deal of its previously unassailable credibility.

It is neither oversight nor mistake that the top link in the sidebar to the right remains Fed has NO Cred!! That links back to our March 23rd Fed’s Normalcy Bias Crumbles. One might think that if it is so clear to even humble analysts like us that the idea the US economy was getting back to normal (NOT the ‘new normal’) into and after last December is misguided, then the allegedly smartest finance minds in the world could also figure it out.

Data Remains Weaker Than Expected

The bottom line is indeed that the world-leading US economy has just not gotten its old form back on the post-Crisis recovery in the way it did in every other post-World War II recovery. While the Obama administration has cooed about all of the jobs it has gained that exceed the number lost in the post-Crisis recession, the caliber of those jobs is still much weaker that the ones that were lost. This shows up in the still weak monthly Hourly Earnings figures (back down to just +0.10%) in the most recent Employment report.

This was apparent again in some of the most disappointing post-Jackson Hole economic indications. Those include last Thursday’s US Retail Sales coming in negative versus positive projections and the slightly later US Industrial Production being even weaker than already weak estimates. More reason to doubt the FOMC can reasonably raise rates at Wednesday’s meeting.

Delinking is a Myth

And the degree to which all of that is not just a US domestic concern came home to roost in recent international trade tendencies highlighted in Monday’s a very good Financial Times article Slump in US imports threatens to derail emerging market growth (our highlighted version.) Some of the observations there might seem a bit alarmist if they were not based on hard data.

As important in the wake of various ‘delinking’ theories over the years, it notes that “the engine of growth for the world’s developing economies (our note: the US and to some degree Europe) is sputtering.” In the wake of the 2008-2009 crisis there were many theories on how the emerging markets and lesser economies might rescue the developed economies from their weakness.

This was always pure folderol, as their cumulative size and ultimately maximized development would never have been anywhere near enough to rescue the cumulative Gross Domestic Product of the United States, much less Europe as well. According to the FT article, “The downturn in US demand was particularly sharp in July, when imports from China fell 3.5 per cent in value and 1.6 per cent in volume on a rolling 12-month basis, according to the Fed data.”

It goes on, “Most people’s explanation for slowing global trade is that it’s due to China sucking in less imports. But [the US data] point to flat or falling imports in the industrialised countries. The US is in more trouble than people realise.” And that last bit is what is becoming apparent on the serial weak international merchandise trade numbers we have been sharing through various serious analysts for many months. As we recently noted on projections from the IMF, OECD and World Bank, all are concerned about international trade sinking to levels that have been consistent with every serious global economic contraction since WWII.

Still a Structural Reform Issue

As such, unless the US resumes its growth at better levels than the ‘new normal’ the Obama administration is consistently touting as a great achievement, the risk of sinking back into recession is still out there. Of course, this once again highlights the actual failing of the central banks not being the extremely low rates or Brobdingnagian accommodation via massive Quantitative Easing (QE) programs.

With the notable exception of Mario Draghi at the ECB it is their lack of willingness to challenge the political class to finally provide the structural reforms necessary to leverage all of the central bank accommodation out of cyclical assistance into structural growth. And as noted previous, there is little chance the most important economies will see their highly partisan political classes find grounds for the sort of compromise necessary to achieve that. In light of recent election results and looming critical contests, this hardly requires further discussion in this post.

OECD CLI Lost in the Shuffle

A week and a half ago we were all rightfully engrossed in what the ECB would or would not do at its most recent rate decision meeting, and what would be communicated at the ensuing press conference. While the press conference discussion was accommodative, the lack of any expansion of its QE program in the official decision disappointed market expectations. Along with the additional hawkish Fed foolishness, that was part of the US equities meltdown into Friday the 8th.

With all of that focus on more immediate influences, it was not necessarily a surprise that the Organization for Economic Cooperation and Development’s first Composite Leading Indicators in three months (i.e. due to post-Brexit vote suspension) released that Thursday morning was ‘lost in the shuffle’. Yet it was also a very telling indication that things are definitely not right in Europe, and the rest of the developed world’s economies remain in a less than robust state. Rather than our description or the OECD headline writer’s typically (sometime less than clear why) upbeat title of the release, we suggest you take a look for yourself.

Extended Trend Assessment is available below.

The post 2016/09/20 Commentary: FOMC Won’t Hike (late) appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.