2016/10/13 Commentary: Fear of Fed… with a twist

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY: Thursday, October 13, 2016

Fear of Fed… with a twist

There was not really any mystery in the equities anticipation and subsequent negative reaction to Wednesday afternoon’s FOMC meeting minutes. Some might feel that the degree of weakness spilling over into Thursday morning was overblown. Yet very typical compounding factors from the Fed’s extended ‘normalcy bias’ are in play once again. It would be comical if it were not tragic that the alleged leading developed world central bank is incrementally diminishing its credibility. That has not just been the case of late. This goes all the way back to and especially after last December’s first minor base rate increase in almost a decade. (For more click into the Fed has No Cred! link near top sidebar; and that was from back in March.)

There was not really any mystery in the equities anticipation and subsequent negative reaction to Wednesday afternoon’s FOMC meeting minutes. Some might feel that the degree of weakness spilling over into Thursday morning was overblown. Yet very typical compounding factors from the Fed’s extended ‘normalcy bias’ are in play once again. It would be comical if it were not tragic that the alleged leading developed world central bank is incrementally diminishing its credibility. That has not just been the case of late. This goes all the way back to and especially after last December’s first minor base rate increase in almost a decade. (For more click into the Fed has No Cred! link near top sidebar; and that was from back in March.)

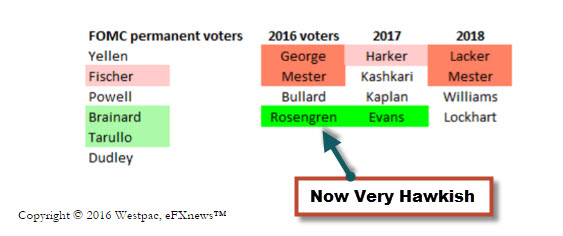

And there is a very interesting twist regarding the next in the series of ‘done deal’ rate hikes that have not happened so far in 2016, where the Fed predicted four last December. That ‘twist’ is the changes to the FOMC voting members in 2017, effective at the first meeting. The question becomes the incentives to raise rates at the last meeting of the currently much more hawkish FOMC, or decide that conditions are still inhospitable for anything that might weaken an already less than strong US economic growth.

In that regard the Fed seemingly remains ‘data dependent’, which is one of the key reasons it was destructive folly to put forth such aggressive US growth and interest rate projections along with last December’s rate hike (see our December 16th post.) This was a clear example of enlisting an aggressively bullish future view to justify what they did.

And it is much the same at present. Yet even the current minutes and changes in the economic data since the FOMC meeting are once again belying the Fed’s ‘rose-tinted’ economic view. While there is much more on that below, first consider that FOMC voting dynamic. December will be the last meeting of the currently most hawkish FOMC voting members prior to a dovish shift into January 2017 for the balance of the year.

How this will play out makes all of the near term economic data even more important. Will the outgoing voting members be interested in a smooth transition into what will clearly be a more dovish FOMC? OR… do they adopt a Nike strategy and “Just do it”? This is critical on other levels as well, especially the current likely result of the US general election.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: Back on the evening of December 8th we posted our major Extended Perspective Commentary. That reviews a broad array of factors to consider Will 2016 be 2007 Redux? For many who believe that the US economy is really strengthening and can once again lead the rest of the world to more extensive recoveries, this may seem a bit odd.

Yet there are combined factors from many areas we have been focused on since the early part of last year which are less than constructive for the global economy and equity markets. We suggest a read if you have not done so already.

We pointed out in December in the face of another likely Santa Claus Rally this was not an actionable view during the year-end equities rally. Yet it was (and remains) important background to utilize into 2016. This is much like our major late 2006 perspective on Smooth Rebalancing? …or… The Crash of ‘07? In that instance the economic factors built up, but the actual crash was deferred into 2008. It is starting to feel this one may be deferred as well.

▪ Prior to moving on to more of the economic and electoral considerations, that review of the sheer FOMC voting dynamic is very important. It is a major shift that reinforces something that was mentioned by New York Fed President William Dudley prior to Wednesday afternoon’s FOMC minutes release: the Fed can afford to be gradualist.

The full dissection of the opening graphic’s implication requires dissection of the real current nature of the key voting members’ perspective. Thanks to Sean Callow of Westpac FX Strategy for the table and eFXnews for posting it. The original web post is available via this link: http://bit.ly/2eadgOd

One of the better breakdowns of the FOMC minutes was Wednesday afternoon’s Bloomberg analysis (our extensively marked-up version.) Please note the additional background that Messrs. Torres and Condon added at the end of their article regarding still lagging US inflation and the latest downgrade to US GDP. These are both the sorts of things that continue to act as a restraint on the Fed hawks.

The Marked Balance Shift

And the FOMC voting balance shifts markedly in favor of the doves after December. As our tag notes in the opening graphic, Eric Rosengren is now actually a very aggressive hawk. As we noted previous, and as was apparent in the comments in the minutes, he is the prime mover behind (with all due respect) a classically inane reason to raise the rates even if the current situation does not warrant it:

That the Fed (per Bloomberg) “…could pose risks to the economic expansion if the Fed had to tighten too rapidly.” Once again with due respect, that is somewhere between daft and plain old wishful ‘normalcy bias’ thinking. This is the same as his historically less than effective perspective we noted in the opening section of our September 20th FOMC Won’t Hike post. The hawks also noted that a further delay after so many pronouncements on the benchmarks being right “…risked eroding the Fed’s credibility.” Hate to tell them, but that ship has already left the dock and will be totally out at sea very soon.

FOMC Numbers Do Not Add Up

Down to the fine line FOMC vote shift beginning with the first meeting in 2017 and continuing throughout the year, the doves have it. This does not mean that US base rates categorically cannot rise. As we have repeated for many months, if the political class ever gets together on meaningful structural reforms that spur the US economy, rates can and should head higher. We revisit the potential for that (or lack of it) below.

Yet the sheer vote shift in favor of the doves among the FOMC voting members is glaringly apparent. Current strong hawks include Esther George, who has been in favor of a rate hike and dissented from the ‘hold’ decision at every meeting since last December. Also in that group are fellow dissenters from the September meeting Loretta Mester and converted dove Eric Rosengren. In January they will be replaced by the marginally hawkish Mr. Harker and eternally dovish Mr. Evans, joined by the neutral Messrs. Kaplan and Kashkari.

As such, the December meeting will be critical to the hawks as their 2016 swan song where they will likely vigorously push their perspective. This is very reminiscent of the period right before previous well-respected and hawkish Dallas Fed President Richard Fisher retired in September 2015. Yet as various domestic and international economic and market conditions had weakened, his pleas were not able to convince the Committee.

[As an aside, we have the highest regard for Fisher, both in his prescient warnings about the housing and credit bubbles back in 2007 and sharp criticism of Ben Bernanke’s massive expansion of Fed Quantitative Easing in 2013. As regular readers know, we also thought this action by Bernanke was merely taking the political class off the hook from needing to pursue necessary structural reforms.]

If the economic data does indeed exhibit sustained strength, possibly the rate hike will be justified. However, if the current neutral and dovish (especially Lael Brainard) members are not convinced, the hawks will fade into year-end once again. And that will create an even greater hurdle to any rate hikes in the first half of 2016 as the doves dominate.

Neither Do the Latest Economic Indications

Here we go again! As we have already explored this at length in quite a few previous posts (especially in the early section of that September 20th FOMC Won’t Hike post), we will be succinct. The Fed is caught in a vicious cycle of repeated missteps, due to longstanding ‘normalcy bias’. It tends to take every positive swing in economic data as a sign it needs to get hawkish. And when the data erodes, it tries to remain hawkish in spite of it.

That is in good measure why the equities respond so miserably to weaker economic data in the Fed’s more hawkish phases. If there is going to be a hike in spite of weak data, it is the worst confluence of factors for the equities, even if the govvies begin to rally in the wake of the weaker economic indications.

And what are we seeing at present that might be bothering the equities if the FOMC is going to hike in December no matter what? Even allowing there is limited US economic data this week until Friday’s Retail Sales, it has been of a somewhat critical nature. There was Tuesday’s NFIB Small Business Optimism that weakened in spite of higher estimates.

Then we saw the Labor Market Conditions Index Change closely watched by the Fed. It was supposed to bounce back from last month’s surprisingly weak -1.3 reading to a positive 1.5. No such luck, as it actually dropped further to -2.2. This is particularly important in the context of US small business being a major factor in the creation of new jobs.

And as far as the international picture, there was some passingly good news in Europe earlier in the week. Yet this morning saw a major erosion of the Chinese Trade Balance that included a much worse than expected 10.0% drop in Exports that were already weak last month. Unless the Euro-zone Trade figures and US Retail Sales show some strength on Friday, this will be another round of the Fed’s “economic data trap” due to that normalcy bias it established as part of its wishful thinking back in mid-2015.

Another Real Economy View

A while back we shared a CNBC video of Waste Management CEO David Steiner sharing his thoughts on why the future of the US economy had little to do with the Fed’s next incremental 25 basis rate decision. It is just not anything corporate heads are going to act upon in a vacuum. He said that he and other corporate leaders needed tax reform and regulatory rationalization to encourage investment and hiring.

On Tuesday CNBC’s Rick Santelli welcomed Chapman University Economics Professor Mark Skousen for a further discussion of “Stuck in slow economic growth?” and how the politics and economics were likely to play out after the US election. Much as we had articulated in our October 1st Dual Dystopia? post, more ‘comfortable’ candidate (and at this point likely winner of the US presidential race) Hillary Clinton is the wrong candidate to resurrect US economic growth. He noted the US is already in a multi-quarter business recession, and unless there are tax cuts, regulatory reductions and fiscal stimulus the US is going remain stuck in anemic growth.

▪ And on that cheery note we end our review of just how fraught the US central bank decision is going to be into December, and just how much more critical all of the economic data between now and then is going to be.

The Evolutionary Trend View market indications remain the same as the Extended Trend Assessment Market Observations in the lower section of Tuesday’s post that were updated early Wednesday morning. We will be updating those again on Friday, yet have not decided yet whether that will be necessary early in the day or will wait until after the US markets Close for the weekend.

Extended Trend Assessment is available below.

The post 2016/10/13 Commentary: Fear of Fed… with a twist appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.