2017/02/22 Commentary: European Kool-Aid II

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Wednesday, February 22, 2017

European Kool-Aid II

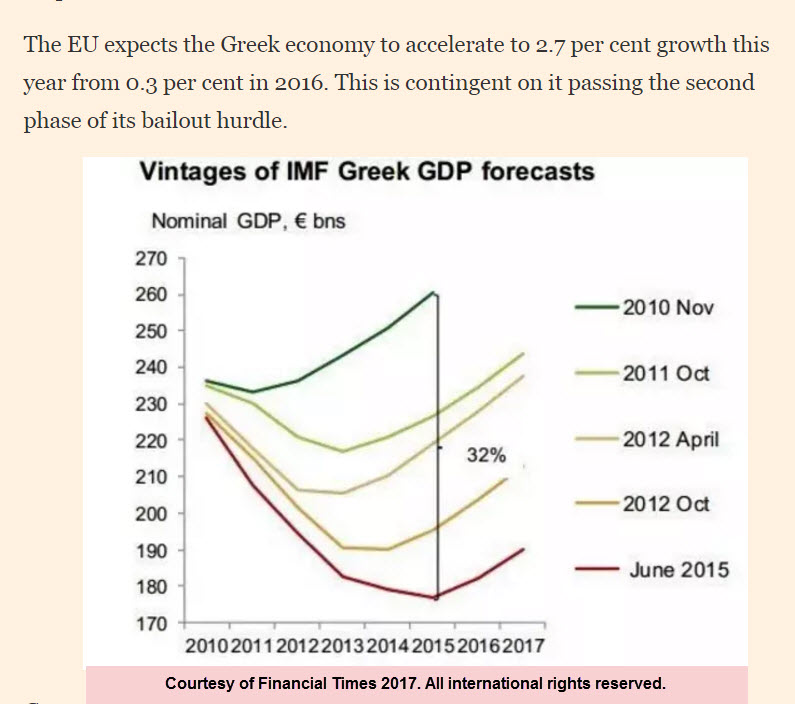

In the endless game that is the European and Euro-zone economic and fiscal reform effort, ‘kick the can’ has become the normal operating procedure. Anyone who doubts that can just reference how many years (not just months or quarters) it has now been that ECB President Draghi has complained that the necessary ‘structural reform’ complement to ECB’s monetary stimulus has not been anywhere near as extensive as necessary to reinforce the ECB’s efforts. And when it comes to lack of movement there is also the still intractable position of the creditor nations in Europe toward Greece’s continued debt problem. For years they’ve made downward revisions to overly optimistic anticipation of stronger Greek growth (more below.)

In the endless game that is the European and Euro-zone economic and fiscal reform effort, ‘kick the can’ has become the normal operating procedure. Anyone who doubts that can just reference how many years (not just months or quarters) it has now been that ECB President Draghi has complained that the necessary ‘structural reform’ complement to ECB’s monetary stimulus has not been anywhere near as extensive as necessary to reinforce the ECB’s efforts. And when it comes to lack of movement there is also the still intractable position of the creditor nations in Europe toward Greece’s continued debt problem. For years they’ve made downward revisions to overly optimistic anticipation of stronger Greek growth (more below.)

This is the ‘European Kool-Aid’ that assists those creditors in believing they can avoid admitting that Greece cannot possibly return to real growth (or a normal society) without more significant debt forgiveness. All of our reasons for that that Greek weakness, and even the degree to which the International Monetary Fund (IMF) tends to agree that further significant debt forgiveness is necessary, were reviewed at length in last Wednesday’s Commentary: Greece (again)? European Kool-Aid post. We refer you back to that for the extended discussion. Yet there is now another chapter in that failure.

It is the classic ‘kick the can’ (i.e. “kick the can down the road” in order to delay dealing with the problems until later) response of the European Union (EU) and IMF negotiators in the face of a self-imposed deadline to reach agreement by Monday of this week… or maybe not really a ‘deadline’ at all. As noted in last Wednesday’s post, there were some serious disagreements even on the IMF’s board regarding the degree of the budget surplus Greece can achieve over the next several years. As discussed then, the non-European members of the IMF were attempting to stand up to Europeans who were demanding a much higher surplus requirement. Needless to say, that once again entails further major benefits cuts and higher taxes in a Greek economy that has already been decimated by six years of cutbacks. That has shrunk the Greek economy to the point where even the same levels of debt are very realistically harder to service…

…a classical ‘devolutionary’ spiral where the debt cannot ever be handled by the smaller economy. So what do you think happened in the EU-IMF disagreement?

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: Given the likelihood the US economy will now get the structural reform that we (along with Mario Draghi and others) have been loudly complaining was not forthcoming since our dual It’s Lack of Reform, Stupid posts in January 2015, we need to adjust our view that a potential economic and equity market failure is coming. We previously referred you back to our December 8, 2015 post for our major Extended Perspective Commentary. That reviewed a broad array of factors to consider Will 2016 be 2007 Redux? While a continued regime of higher taxes and more regulation (i.e. under Clinton) might have fomented a continued weak or even weaker US economy, the tax and regulation changes proposed by a Trump administration that will likely be approved by the heavily Republican Congress now diminish the similar fears we had to what transpired in 2007-2008.

▪ Yep, the ‘more stringent requirements’ European faction at the IMF managed to impose a goodly bit of legerdemain on the ‘more debt forgiveness’ prone non-European wing. It has been decided that maybe Greece can indeed hit that higher budget surplus target. In other words, it is more of the same parsimony and dispensing punishment to the Greeks. That is for their sin of taking advantage of the European banks mindless extended purchases of less than credible major Greek government bond offerings into 2009 (the original ‘European Kool-Aid’, and see last Wednesday’s post on that.)

The truly specious nature of the EU-IMF ‘agreement’ (at least tacitly so) into Monday’s previous ostensible ‘deadline’ is highlighted in an excellent Financial Times Eurogroup hails progress with IMF on Greek debt deal (our marked up version) article posted late Monday. It fully articulates the degree to which this is merely short-term confrontation avoidance (‘kick the can’) rather than any actual conclusion that Greece is capable of hitting the more stringent budget surplus targets the European creditors are once again blithely asserting can be achieved… to avoid the actual necessity of further debt reduction. [We recommend an FT subscription for anyone not already signed up.]

Not This Week, But Soon

This is a formula for actually triggering another ‘Greek Debt Crisis’ as its actual next major debt repayment deadline arrives in July. While the IMF’s European directors have held sway for now, according to the FT article a senior IMF official has noted, “But differences remain on several important issues and we are clearly still well away from a staff level agreement.” In other words, IMF has agreed to take a further look while still leaving quite a bit of room to disagree with the EU… agreeing to disagree yet sending a team back to Athens for further study in spite of IMF skepticism. Yet this is being reported as some sort of resolution of EU-IMF-Greek government issues. In Trumpian terms: fake news.

Greek Government Complicity

And most bizarre of all in many rational observers point of view is the Greek government’s complicity in imposing yet more crushing reforms in order to achieve the near term goal of hitting a 3.5% fiscal surplus. Yet this would need to be sustained over the long term, which almost no other country had ever achieved… much less one with a damaged and weakened economy. This is the view of many independent observers.

We have often cited the analyses from Wolfgang Münchau of Eurointelligence in his FT commentaries over the years on the misguided precepts driving the Euro-zone and EU policies. His assessment of the Greek debt situation early last week noted A failure to tell the truth imperils Greece and Europe (marked up version) as even the Greek government had miscalculated in siding with the EU against the IMF. Whereas right after being elected the Tsipras’ government took the position that a fiscal surplus of 3.5 percent is economically counterproductive and politically suicidal, it ultimately caved in to the EU. As Münchau notes, “He thought the target was soft… he could always compromise with the Europeans on structural reforms… (and) also miscalculated in assuming that the IMF would be complicit in such a deal.”

History Doesn’t Lie

And getting back to the reality of previous EU and Euro-zone reliance on overly optimistic Greek growth projections as a means to avoid the ugly truth that Greece must either get more extensive debt relief or ultimately leave the Euro-zone, a picture is worth 1,000 words (from a February 13th FT article on Greek yields)…

|

So the EU’s position on the likelihood of Greek growth being sufficient to achieve the necessary fiscal surplus target is not just misguided for this round of further bailout funding negotiations. It is the classic definition of the actions of a ‘crazy person’: doing the same thing over and over again while expecting a different result.

Kool-Aid Wins Again

However, it is the tendency of most people (and entities) to continue to trust in things which support their belief system over even glaringly apparent reality. As Münchau’s FT Comment also noted, “Another untold truth is that Germany will never forgive Greek debt. This is because the German parliament will not accept it, and the number of MPs hostile to Greek debt relief will be even higher after the September election.”

With little appetite for approving Greek debt forgiveness that would further damage Angela Merkel’s party into the elections, and a greater presence of those opposed to it (and even German Euro-zone membership) after the election, there is no other politically viable position for any of the EU players than to grudgingly accept the canard of the potential for higher Greek growth than is at all reasonable in the current circumstances. Including even the Greek government.

So pass the Kool-Aid and drink hearty… at least unless the IMF finally bites the reality bullet and refuses to participate in the charade. It is going to be very interesting to see whether another significant Greek Debt Crisis can be avoided this summer. This is taking on a familiar sense of ‘slow motion train wreck’ where the engineer is drunk on an “austerity is the only path to growth” Kool-Aid habit he should’ve been able to kick a long time ago... at least as it concerns deeply damaged economies.

The Extended Trend Assessment with full Market Observations updates will be provided after today’s US Close in order to include the market reactions to the FOMC Meeting Minutes release prior to more critical economic data on Thursday.

The post 2017/02/22 Commentary: European Kool-Aid II appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.