2017/03/16 Quick Take: ‘Fecstasy’ Wins… For Now

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Quick Take: Thursday, March 16, 2017

‘Fecstasy’ Wins… For Now

As explored in Wednesday morning’s Quick Take: ‘Fecstasy’ or ‘Fedache’? post, there was a choice between Janet Yellen providing exact ‘on target’ encouragement for the US economic outlook and the US equities psychology, or signaling more active further 2017 base rate increases. While the latter was deemed a possibility, Wednesday morning’s post covered all of the reasons why the Fed Chair both had latitude and incentives to remain circumspect on the future path of the federal funds rate. The interesting part is that the govvies were also encouraged by the Fed’s still accommodative stance. The interest rate trend being led by the longer dated bond yields is something we have noted for many years, and focused on again of late.

As explored in Wednesday morning’s Quick Take: ‘Fecstasy’ or ‘Fedache’? post, there was a choice between Janet Yellen providing exact ‘on target’ encouragement for the US economic outlook and the US equities psychology, or signaling more active further 2017 base rate increases. While the latter was deemed a possibility, Wednesday morning’s post covered all of the reasons why the Fed Chair both had latitude and incentives to remain circumspect on the future path of the federal funds rate. The interesting part is that the govvies were also encouraged by the Fed’s still accommodative stance. The interest rate trend being led by the longer dated bond yields is something we have noted for many years, and focused on again of late.

Yet in the Market Observations update in our WEEKEND: Hawkish Draghi? & Bull Age post, we were clear that the heavy recent selloffs may have left the govvies in a positon to rally; especially the recent weakness in new downside leader German Bund. This is not a major shift in our overall bearish view of the govvies. Yet as also noted previous, the early phase of govvies bears tend to be ‘trending’ rather than more accelerated implosions.

And indeed it has been the case once again that the longer dated bond yields led interest rates higher ever since the US election result. That had already rippled down into the short end of the curve as well. One very insightful longtime financial business participant responded to mention of the Fed raising the federal funds rate by noting, “The federal funds rate had already raised itself. The Fed merely came along and confirmed the trend.”

We have witnessed this tendency in most major trend shifts in the interest rates. It is not the central banks’ mandate to dictate rate changes that are not already based on some dynamic shift in economic conditions. And as the longer dated debt instruments are more sensitive to any shift in conditions, they tend to have already reflected any of those changed circumstances prior to the yields rippling down the curve into the short end.

Yet the more impressive reaction Wednesday afternoon was the sharp rally in US equities that once again led the other international stock markets. That includes a new all-time high in FTSE even if the DAX and NIKKEI are lagging. The question now is whether the US equities continue to lead higher? It may be more so likely they stall again if the other current major influences come back to the fore, which is likely to occur fairly soon.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: Given the likelihood the US economy will now get the structural reform that we (along with Mario Draghi and others) have been loudly complaining was not forthcoming since our dual It’s Lack of Reform, Stupid posts in January 2015, we need to adjust our view that a potential economic and equity market failure is coming. We previously referred you back to our December 8, 2015 post for our major Extended Perspective Commentary. That reviewed a broad array of factors to consider Will 2016 be 2007 Redux? While a continued regime of higher taxes and more regulation (i.e. under Clinton) might have fomented a continued weak or even weaker US economy, the tax and regulation changes proposed by a Trump administration that will likely be approved by the heavily Republican Congress now diminish the similar fears we had to what transpired in 2007-2008.

▪ And the likelihood of that was implicit in the reasons Yellen & Co. were able to remain so circumspect in their federal funds outlook for 2017. This is exactly as noted in Wednesday morning’s Quick Take: ‘Fecstasy’ or ‘Fedache’? post. Rather than review all of that here, we suggest a read of that for anyone who has not done so already.

Yet some of the key highlights are as follows. In the first instance, while some economic improvement is clear after the long struggle through most of the regulation heavy Obama years, there is still quite a divide between actual economic growth and the anticipation based on the assumptions from the Trump administration reform and stimulus plans.

The latter are no doubt a good reason that equities had rallied as far as they did into the stellar blowoff to the new all-time high right after Mr. Trump’s Tuesday, March 1st address to Congress. Yet as noted early on in Wednesday’s post, while edging up from the very weak multi-year US GDP growth below 2.00%, the expectation it can gallop up to 3.00% or higher levels anytime soon is tied into the Trump reform agenda success.

Impasse a Blessing for FOMC

As the Trump agenda is at present under the cloud of the stalled healthcare reform at present, there is not yet any reason to believe the stronger growth that can very likely bring higher inflation is imminent. While it might seem a bit perverse, the US healthcare reform impasse is therefore of huge benefit to the Fed and Chair Yellen who want to remain more circumspect right now.

Lacking a definitive dynamic for stronger future US economic growth which is contingent on the extent of tax reform, the Fed can remain more circumspect without appearing to be behind the curve on any inflation anticipation. In fact, when specifically asked by CNBC’s Steve Liesman whether the Trump tax and regulatory changes had even been discussed, the answer was “No.” That is based on the still nebulous nature of any actual reforms.

Of course as also noted repeatedly of late, the more major tax reform that could be a real tonic for the US (and global) economy remains contingent on the completion (or at least clear budgetary parameters) of the healthcare reform. That compounding factor on the lack of progress on healthcare reform is the much greater complexity than the Trump administration expected.

This is a real stumbling block as the administration attempts to sell it to skeptical conservatives and moderates. Just one point is the difference in even Republican states where some governors expanded Medicaid and other refused.

The real problem is…

Equities Might Get Stale Again

All of the US equities euphoria over the Fed seeming more gradualist than some had feared is once again based on the US economy remaining weaker than many are expecting under the full Trump reform agenda. While the Fed Chair was indeed upbeat about the encouraging signs like firmer business investment and nearing the Fed’s employment goals, she still indicated a very moderate level of growth.

And that is inconsistent with the current anticipatory levels the US equities have achieved on far better corporate earnings assumptions. And as far as any corporate earnings improvement goes, even if that transpires under whatever degree of reforms are actually implemented, the real impetus for higher growth is personal income and spending. Especially under current circumstance that looks less likely, especially if the current healthcare reform effort drags on much longer… which may weigh on equities again.

What Chair Yellen Actually Said

In the second case the Fed Chair confirmed that current projections consistent with a lack of actual fiscal changes based on the Trump agenda, the Fed remains as ‘data dependent’ as previous. While she did not volunteer this as she (and various previous FOMC statements) had done before, there was a telling question from Bloomberg’s Kathleen Hayes near the end of the press conference. After quite a few questions regarding whether the Fed might be behind the curve of the Trump agenda become reality and need to become more aggressive, Hayes was clever enough to inquire on the contrary.

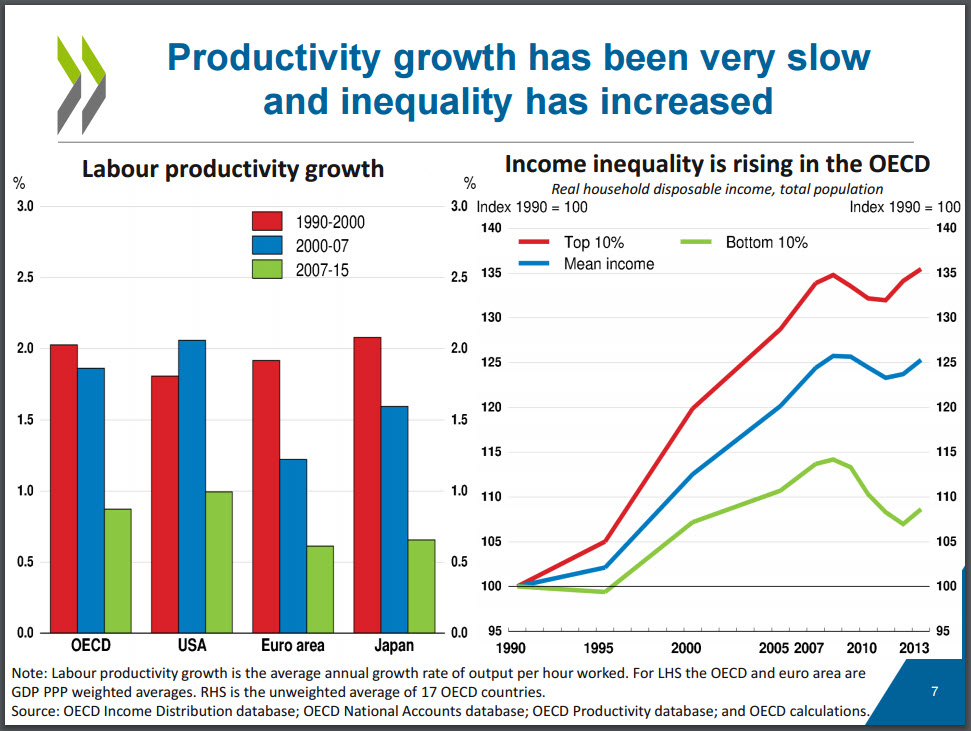

She specifically cited the lack of productivity gains and attendant weak wage growth to point out that the real drivers for future inflation may be less pronounced than the current anticipatory psychology suggests. And Fed Chair Yellen agreed that this is a problem, and if conditions were to weaken in the future (i.e. contrary to current expectations) the Fed remained ‘data dependent’, and would be ready to move back to more accommodation.

That is a telling insight, and as reviewed in our Commentary: OECD versus ADP post last Wednesday, it is consistent with the concerns expressed by the Organization for Economic Cooperation and Development (OECD) on the significant upward adjustment in so many equities markets. The OECD’s concerns are that the equities strength seems to be based merely on the assumption that previous central bank stimulus efforts will work in conjunction with Trump’s proposed reforms.

Yet a look at the low level of actual productivity does reinforce Ms. Hayes point about how much better the economies can get if worker productivity is stuck at such a low base. All of this was reviewed in more detail in last Wednesday’s (March 8th) Commentary: OECD versus ADP post, and we suggest a read for anyone who has not already done so.

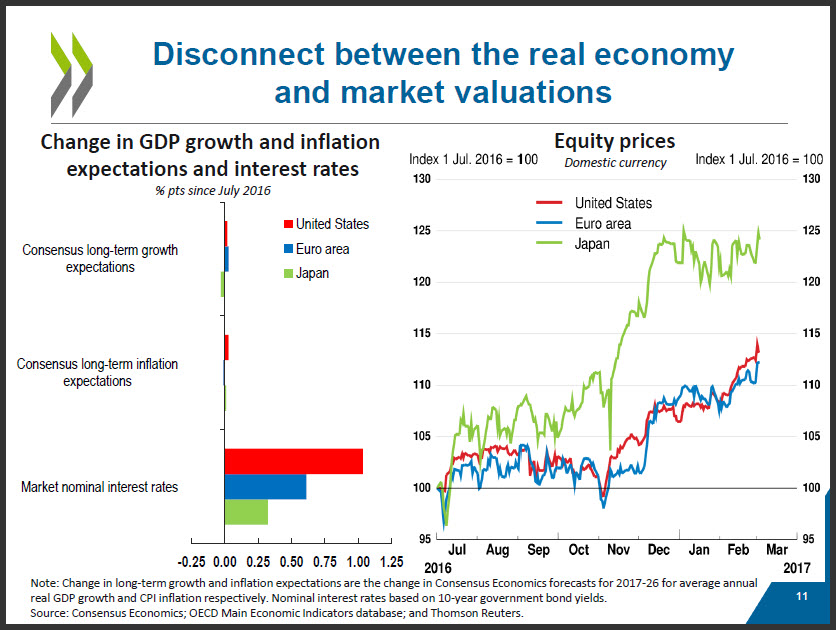

While graph above illustrates the productivity point as a possible drag on consumer spending that might encourage higher inflation and the federal funds rate, there was another chart (below) in last Tuesday (March 7th) morning’s OECD major semiannual Interim Economic Outlook formal presentation that was not included in last Wednesday’s post that is even more instructive for equities valuations. That is also available in the key points summarized in the associated PowerPoint presentation accessible on that page.

While the OECD might be a bit parsimonious in its estimates of long term future growth, the graph illustrates just how far the growth improvements need to go to support current equities valuations. It is very possible that OECD’s view is conservative because it does not want to assume just what any major repatriation of US international company profits might mean. It is also very much in line with the current US tax regime, without the assumed improvements if the Trump agenda drop to a top corporate tax rate of between 15% and 20% is actually achieved once the healthcare reform impasse is addressed. That would create an immediate major jump in retained corporate earnings which would go a long way toward justifying the equity market valuations in the near term.

While the OECD might be a bit parsimonious in its estimates of long term future growth, the graph illustrates just how far the growth improvements need to go to support current equities valuations. It is very possible that OECD’s view is conservative because it does not want to assume just what any major repatriation of US international company profits might mean. It is also very much in line with the current US tax regime, without the assumed improvements if the Trump agenda drop to a top corporate tax rate of between 15% and 20% is actually achieved once the healthcare reform impasse is addressed. That would create an immediate major jump in retained corporate earnings which would go a long way toward justifying the equity market valuations in the near term.

Market Response

However as noted above, it is clear it has not been ‘fear of Fed’ that has driven the recent US equities selloff since the recent new all-time highs. As such, it is not likely the now confirmed more circumspect than some anticipated FOMC stance is not the only key.

As it has been more so the disappointment with the potential for Trump’s reform agenda to be implemented timely after the impasse over the House healthcare reforms plan, there is room for those concerns to weigh on the equities once again. As noted repeatedly, those are an essential precursor to the more important tax reform effort. Therefore as also already noted previous, US equities that are leading the others may not restore their previous bullish tone even after Fed Chair Yellen was ‘angelic’ in her further benign (no more than two further hikes planned for 2017 at present) communication.

▪ The Extended Trend Assessment with full Market Observations remains the same as the full update in the lower section of our WEEKEND: Hawkish Draghi? & Bull Age post noted above. We refer you back to that for any of your specific market interests, as even the recent significant price swings in all markets remains thoroughly consistent with the views and technical parameters expressed there.

The post 2017/03/16 Quick Take: ‘Fecstasy’ Wins… For Now appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.