2017/09/21 Commentary: Fear of Fed Redux

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Thursday, September 21, 2017

Fear of Fed Redux

As we had suspected in our Wednesday morning Commentary: Fear of Fed post, ‘Fed dread’ is back. That was just an extension of the somewhat stronger economic data releases in spite of weaker important US data last Friday. Yet, ever since Hurricane Irma was a bit less devastating to Florida than had been feared, the US equities were keeping the bid and govvies were under pressure since the beginning of last week. Especially in the context of higher than expected UK inflation numbers initially followed by others, the govvies finally had to be more concerned about that than responsive to the near term economic weakness engendered by the US dual storm damage.

As we had suspected in our Wednesday morning Commentary: Fear of Fed post, ‘Fed dread’ is back. That was just an extension of the somewhat stronger economic data releases in spite of weaker important US data last Friday. Yet, ever since Hurricane Irma was a bit less devastating to Florida than had been feared, the US equities were keeping the bid and govvies were under pressure since the beginning of last week. Especially in the context of higher than expected UK inflation numbers initially followed by others, the govvies finally had to be more concerned about that than responsive to the near term economic weakness engendered by the US dual storm damage.

Of course, this took on extra importance in the context of the upcoming FOMC meeting that culminated in Wednesday afternoon’s statement and projections revisions, followed shortly thereafter by Chair Yellen’s press conference. And we have followed our classical protocol that the knee-jerk reaction to the FOMC impact is less important than the 24-48 hour trend evolution the markets need to reflect their full response. That has been very telling in the US dollar as well, and especially the govvies that have swung down into their most critical position since early July.

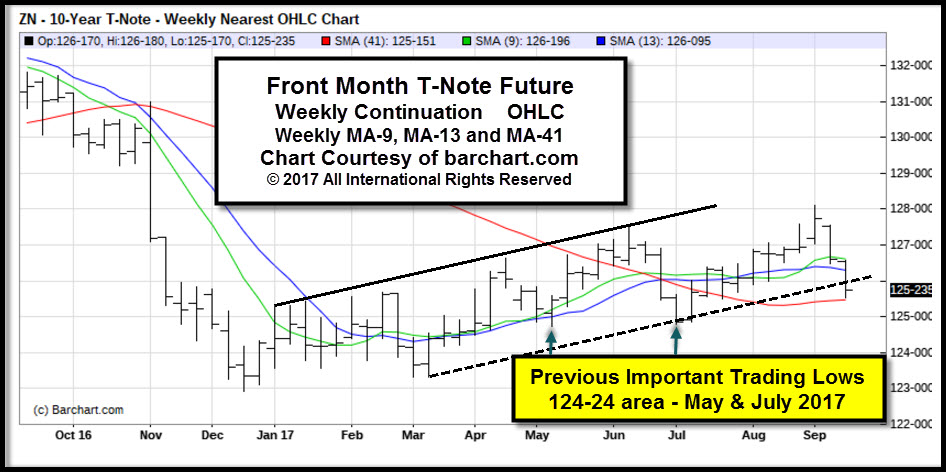

That is the reason we opened with a weekly front month T-note future continuation chart illustrating the consideration of whether the December T-note future will respect overall up channel support from the 122-29 mid-December post-US election trading low. While it has penetrated that up channel support to some degree, as always with these sorts of things it is more important whether it exhibits a sustained violation of that trend support than whether it drops temporarily below it. And after laying out all of the background on whether the Fed’s shift into reducing its balance sheet will be a telling influence in our previous post, this post will be more market trend oriented after some brief further review of just what the Fed will be doing.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: REVISED 2017-08-31: Like many others, we were encouraged by the likelihood the US economy would get the structural reform we (along with Mario Draghi and others) had been loudly complaining was not forthcoming since our dual It’s Lack of Reform, Stupid posts in January 2015. Since our December 8, 2015 Extended Perspective Commentary we were concerned about various factors that included continued high taxes and more regulation (i.e. under Clinton) that might have meant a continued weak, or even weaker, US economy. It was hoped Donald Trump’s election would change that. However, much like the estimable Ray Dalio (see our August 24th Commentary: Trump Troika post) and others, we are now very concerned that the US President’s diminished relationship with the Republican Congress will mean his tax reform and infrastructure spending agenda will have trouble getting passed into law. And that will quite possibly be a problem for any US economic acceleration, and high-priced US equities.

In the first instance, what the Fed is actually doing is still consistent with all of our observations in Wednesday morning’s Commentary: Fear of Fed post. That includes both the degree to which the much feared balance sheet reduction will be very incremental, and the Fed is still going to be very flexible in maintaining a ‘data dependent’ approach. On the latter, there was significant discussion at the press conference on the potential for the US economy to underperform the Fed’s projections. And in each instance Chair Yellen was happy to note that interest rate increases could be skipped, or the balance sheet might even expand again if the situation reverted to enough weakness.

In the first instance, what the Fed is actually doing is still consistent with all of our observations in Wednesday morning’s Commentary: Fear of Fed post. That includes both the degree to which the much feared balance sheet reduction will be very incremental, and the Fed is still going to be very flexible in maintaining a ‘data dependent’ approach. On the latter, there was significant discussion at the press conference on the potential for the US economy to underperform the Fed’s projections. And in each instance Chair Yellen was happy to note that interest rate increases could be skipped, or the balance sheet might even expand again if the situation reverted to enough weakness.

As such, the Fed’s balance sheet reduction is neither carved in stone nor even very large in the initial phase. Of course the financial press cannot sell newspapers (or online clicks) with headlines like “Not Really Much of a Change.” So this morning’s headlines were focused on the more extensive full impact once the reduction program is in full gear: “Fed to Reduce Balance Sheet $600 billion per Year.”

And ultimately that is correct, yet with a very slow start relative to the Brobdingnagian size of the Fed’s balance sheet. As noted in Wednesday’s post and back in July, Bill Gross and various Fed governors (among others) have likened the initial phase to the equivalent of “watching paint dry.” While not meaning to diminish the impact of the reduction program overall, by starting with just $30 billion in the first quarter the program will likely have not much more than a psychological immediate impact on the bond markets.

And by increasing it by $10 billion per month each quarter (i.e. to $60 billion in the second quarter of operation in Q1 2018), it will also remain rather minimal overall through the first year (October 2017 through September 2018.) The total for that first year will be just $300 billion of a $4.5 trillion balance sheet the Fed is planning to reduce to $2.5 trillion. And as we have also noted previous, there are plenty of takers for those longer term debt instruments if the Fed is making them available once again. Those are the insurance companies and other entities which need longer term fixed yield investments.

And as also noted in our recent and previous posts, the pricing of the high-grade bond markets has little to do with the amount of bonds available: it always reverts back to the ‘real yield’ that is the spread between the bond yield and underlying inflation. For much more on all of that please see Wednesday morning’s Commentary: Fear of Fed post and the previous posts referenced and linked there.

The T-note Trend

Getting back to that opening weekly front month T-note future continuation chart, it is interesting that the slightly discounted (compared to September contract) December T-note future was already into the 126-00/125-24 interim congestion support prior to the September contract expiration… on Wednesday just prior to the FOMC announcements and Chair Yellen’s press conference.

And of course the ostensibly less accommodative (not really fully ‘hawkish’) stance by the Fed governors was enough to create a bit more knee-jerk weakness. Yet at least so far that is not really getting the more aggressive downside follow through which might be expected on breaking the up channel support from the 122-29 mid-December post-US election trading low. While it has penetrated that up channel support to some degree, as always with these sorts of things it is more important whether it exhibits a sustained violation of that trend support than whether it drops temporarily below it.

With the global Advance PMI’s due out Friday morning, we must allow that it could go from bad to worse by the weekly Close. Yet even if there is further pressure, the key lower congestion which must be violated to really confirm the sort of downside follow through consistent with a significant 126-00 area DOWN Break are the 124-24 area May and July trading lows (as indicated on the opening chart.) If so, then the more important lows are the 123-00 area lows held at the bottom of the post-election selloff in December.

Yet that is not just important because it held in December, but also as the key lows after the sharp ‘taper tantrum’ selloff after Chair Bernanke announced the original wind down of the Fed’s QE program in May 2013. Between September 2013 and April 2014 the 123-00/122-24 area was extensively tested. As that is the six year low, that is the ultimate congestion support, reinforced by having held last December.

However, even prior to that there is the consideration of whether the December T-note future remains below the 126-00 area, even if it should Close below it this week. And as we have noted many times of late, it is less important whether a Breakout occurs than whether it is maintained. DOWN Breakouts that are subsequently Negated (i.e. violated in the opposite direction from the nominal signal direction) are often springboards for the return of the up trend.

Gilts and Bunds

And this is also important for the other major govvies that have come under pressure of late on the stronger inflation indications. The September Gilt future remains front month prior to its (typically late) expiration next Wednesday. Yet the December Gilt future is trading at its typical full point discount to the front month, which puts it down into the upper 123.00 area. Its more prominent front month continuation support is into roughly the 123.00 area. As such, that would be the equivalent of the December T-note future support into the 125-00/124-24 area.

The December Bund future has already been front month for a while on its typical early expiration cycle. While it was at a major discount to the expired September contract, it has only dropped near it major 160.50-.00 support so far.

Foreign Exchange

Foreign exchange was also coming under the influence of the US equities’ strength into midweek last week, yet in a more modest and seemingly temporary fashion. And that seems to have repeated itself, including the return of late week softness this week. The US Dollar Index was recovering from below its 91.91 2.5 year low violated on the Close two weeks ago. And as noted previous, that resistance has a Tolerance of no daily Close significantly back above the Negated late-August 92.52 weekly UP Closing Price Reversal.

And so far that was respected on last week’s short-term recovery, with it fading back below .9191 later in the week. And once again this week it is weakening rom a test of the mid-.9200 area. It is possible that the US government hurricane recovery spending that will underpin the US equities has made the more inflation-sensitive govvies more suspect in the near term, and may not be good at all for the US dollar.

While we shall see, it all appears to conform to that theme for now. Also note that while the US dollar strengthened against the emerging currencies on the anticipation of less Fed accommodation, none of that was to a trend decisive degree on reversing the overall US dollar down trend. The key indications there are USD/ZAR not getting back above 13.30 and USD/MXN not getting back above 17.90 (much less the low 18.00 area), even if USD/TRY has managed to claw it way back up into the 3.45-3.55 range after spending some time below it.

Equities

As noted since late July, there was September S&P 500 future resistance into 2,475-80. That resistance was intensified in early August after the failure from above that area left a fresh weekly DOWN Closing Price Reversal (CPR.) That reinforced the importance of 2,475-80 resistance at which it failed repeatedly.

Yet that weekly DOWN CPR Tolerance at the 2,480.50 late-July trading high was overrun on last Monday’s rally. The next resistance is into the 2,518-23 weekly Oscillator threshold (MA-41 plus 130-135) next week. Interestingly now that December S&P 500 future has taken over as front month, this is the extension at which it stalled into 2,475-80 area in early August, with the increase in weekly MA-41 since now also raising that resistance. Major extended Oscillator resistance (not seen since March) will be 2,548-53 next week.

The Extended Trend Assessment with full Market Observations will be updated after Friday’s US Close to fully assess how various markets perform in the wake of the further developments in Fed policy two full days after a major FOMC meeting. That is especially important in this case considering the contingencies the markets (especially the govvies and US dollar) are facing into Friday’s finish for the week.

The Extended Trend Assessment with full Market Observations will be updated after Friday’s US Close to fully assess how various markets perform in the wake of the further developments in Fed policy two full days after a major FOMC meeting. That is especially important in this case considering the contingencies the markets (especially the govvies and US dollar) are facing into Friday’s finish for the week.

The post 2017/09/21 Commentary: Fear of Fed Redux appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.