2015/10/27 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, October 27, 2015 (early)

Draghi’s Disinflation Dirigisme = Equities Elation...

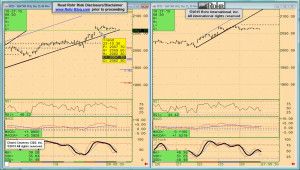

…with special thanks as well to the Peoples Bank of China for its contribution to the ‘bad news is good news’ equities psychology. And a big thank you goes out to economic data as well. In another predictably perverse reaction to what has now become serial weak US Durable Goods Orders indications, the figures there this morning included a full one percent downward revision to already weak data from the previous month… and as of the time of this analysis the December S&P 500 future had only temporarily dipped below 2,060-58 short term support (i.e. violated early 2015 congestion resistance) prior to recovering back into that range.

Yet this is not a huge mystery, as the accommodative central bank ‘bad news is good news’ equities psychology is due for further reinforcement on Wednesday afternoon’s FOMC statement release. Of note, it is indeed a straight statement scheduled for this meeting, so there will be much tea leaf reading on any changes which might indicate whether the Fed will indeed still possibly raise the base rate this year (i.e. at the December 15-16 meeting.) Yet in spite of the continued assertions by some of its far flung minions, the more weak data comes forth, the less likely it is the Fed will hike this year.

And in its perverse way that means ‘bad news is good news’ will continue to be the equities psychology in a world where ‘safe’ investments provide no yield. And among the most interesting aspects is the degree to which this continued ‘risk assets’ being the only way to make a return is also supportive of govvies. With so much weak data expected to continue into the future, there is no ‘inflation psychology’ that will weigh on the govvies. Anyone in doubt on that should just take a peek at the performance of the German Bund.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the central bank factors noted above. However, the addition of OECD Composite Leading Indicators (revisited again below) reinforces all the economic weakness. While there is also the weak influence of global Trade figures, of late some of the data is improving a bit. That includes German IFO, yet with much else remaining weak… like UK GDP and CBI statistics.

It moves on to S&P 500 FUTURE short-term at 03:00 and intermediate term view at 06:15, OTHER EQUITIES from 09:15, GOVVIES analysis beginning at 14:15 (with the DECEMBER BUND FUTURE at 17:45) and SHORT MONEY FORWARDS at 20:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 22:45, EUROPE at 24:15 and ASIA at 26:15, followed by the CROSS RATES at 28:45 and a return to S&P 500 FUTURE short term view at 32:15. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

▪ Revisiting the reasons for the mutual equities-govvies bid, the extreme concern (certainly somewhat warranted) of the ECB over potential negative inflation ended up in a tour de force of the power of the state (in this case its central bank) to influence market psychology at last Thursday’s ECB press conference. While the classical definition of dirigisme might be to be more hands on involved in some actual investment decisions, the power of the ECB, Fed, BoJ, and others to spur equity market activity is most impressive.

While the Fed’s longstanding ZIRP (Zero Interest Rate Policy) was the forerunner of the market influence the others now wield so effectively, there is little doubt continued global downward pressure on interest rates is encouraging further flows into ‘risk assets’… like stock markets. And all of what Mario Draghi accomplished on Thursday regarding the ‘risk on’ psychology was accelerated by Friday morning’s PBoC rate cut.

Of course, the perverse aspect of all this is that the central bank stimulus programs are not actually encouraging a return to the more robust economic growth they all would really like to see. As we have explored at length the failure of the political class to deliver meaningful structural reforms (especially in the US), we will demure here. Suffice to say that of late we have also highlighted once again the significant weakness in global trade.

Volumes are down markedly in a sign of the underlying softness of the global economy. Danish global containerized shipping giant Mærsk sharply cut its profit projections last week due to that slow down. And the primary culprit? Weakness on the Asia-Europe routes. And this is just as Europe is supposed to be the engine that assists the other economies out of their weakness, at least according to the latest OECD Composite Leading Indicators.

▪ As noted since last Wednesday morning’s Global View video analysis post, the continued strong equities responses to recent weak economic data confirmed an erratic yet understandable ‘bad news is good news’ rally. The response to weak Asian economic data (including Japan’s Trade figures showing export implosion that mirrored tendencies elsewhere) was for equities to rally. That was the ‘analog’ for what transpired in a more forceful way on the extremely accommodative language from the ECB last Thursday

And we noted at that time this was likely on a transition from ‘FOMC Friendly’ influence into an ‘ECB Friendly’ influence on the way into last Thursday morning’s rate decision and press conference. And as it turned out, that was a bit of an understatement into Mario Draghi’s tour de force review of all the ways the continued central bank accommodation was both necessary and would be implemented on multiple fronts.

For much more on the full context of the meeting and what both Mario Draghi and ECB Vice President Vítor Constâncio had to say on not just “whatever is necessary” but also why it is still necessary, see Thursday’s Commentary Draghi drives disinflation psych.

▪ And the equities slippage two weeks ago Wednesday leading to strength Thursday morning was not that surprising. And it was essentially repeated on this week Wednesday’s sag back to 2,015-10 being followed by Thursday’s gap higher opening. As we noted ever since erratic activity around the 1,900 area back on October 1st, the short-term failures are historically not likely to remain down in an ‘erratic recovery’ phase of a bear trend. That was very apparent again on the push up to a new high for the overall rally late last week, and again on Thursday.

As a bit of perspective on that noted previous, in spite of rumors to the contrary, there was no hint in those September 16-17 FOMC meeting minutes that keeping rates steady was any sort of ‘close call’; they were roundly dovish. That pushed the December S&P 500 future back above the 1,990 area DOWN Closing Price Reversal signal from back into and after the actual September 17th FOMC announcement and press conference. Apparently if the news is bad enough, the markets suspect there will be even more Fed accommodation. And that is a good part of the reason why 1,990-88 area was not just a technical trend level: It was also the indication of whether the ‘bad news is good news’ psychology could continue to drive an equities rally. What was important again last week for December S&P 500 future on whether that psychology was dominant enough to see it hold that key 2,011-2,020 support (i.e. overrun key resistance) on near term setbacks.

▪ All the rest of the overall background remains much the same as the early sections of the psychology covered back in the Tuesday, October 13th Global View TrendView video post and previous analysis.

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

The post 2015/10/27 TrendView VIDEO: Global View (early) appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.