2016/05/15 TrendView VIDEO: Special 3 - Weekend

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Weekend, May 15, 2016 (weekend)

This Special 3 - Weekend edition of the TrendView video analysis is purposely to update the only three situations which seemed more important than any other markets after Friday’s US Close rang down the curtain on last week’s very important macro-technical developments. On the ‘macro’ front the economic data has remained very mixed, even within individual countries. Note last Monday’s very strong German Factory Orders followed by Tuesday’s very weak Industrial Production. UK data remained weak, and even the positive Chinese and German Trade Balances were in the context of very weak Import data. And historically that has been indicative of a weakening global economy. Also reinforcing that was last Wednesday morning’s OECD Composite Leading Indicators (CLI.) They have been a very useful forward indication for the weakening global economy out of last year in early this year.

They are showing some strengthening from the previous abysmal forward indications for the emerging market economies. Yet their less than optimistic outlook for much of the developed world continues to reinforce our bearish instincts, as you can see in our mildly marked-up version. Especially the weakness of the US, UK and Germany, with stallouts now seeming to start in some of the previously more upbeat European economies, remains negative. The stubbornly upbeat psychology of the monthly report editors shows up once again in a typical ‘rose-colored glasses’ headline trumpeting “Stable growth…” Especially take a look at the highlighted data in the statistical table on page 3 and draw your own conclusions.

The point of all this overall negative background is how it relates to the US equities and govvies response to what was very strong US data on Friday. Everything from the very important strong rebound in Retail Sales to upbeat Business Inventories and especially the ‘over the top’ Preliminary Michigan Confidence (95.8 versus an 89.50 estimate) all should have reinforced the notion there might be a US Q2 rebound from a weak Q1. Counterintuitively the equities dropped to a new low for the week and a one month low weekly Close, and the govvies strengthened right into that strong data.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion of how the ineffectiveness of central bank QE and very low interest rates remain a real problem along with how the strong US economic did not bring the anticipated response on Friday.

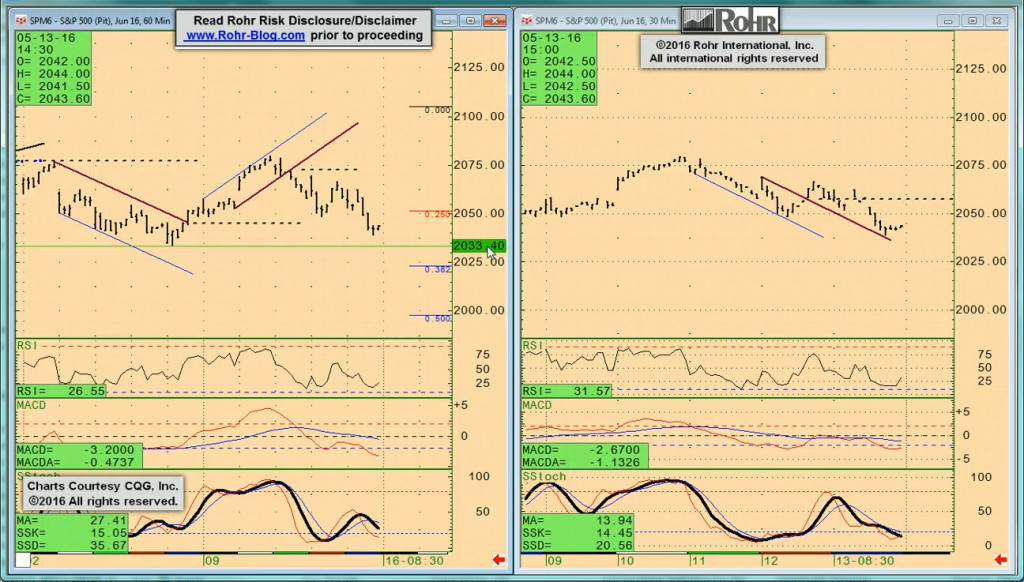

It moves on to S&P 500 FUTURE short-term at 04:30 and intermediate term at 07:45, the GOVVIES (mostly on the T-note future) at 11:45 (with a brief look at the Bund at 16:15), and the FOREIGN EXCHANGE beginning with the US DOLLAR INDEX at 17:30, EUR/USD at 20:45, AUD/USD at 22:30 and USD/JPY at 24:00, returning to S&P 500 FUTURE at 25:30.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

NOTE: Back on the evening of December 8th we posted our major Extended Perspective Commentary. That reviews a broad array of factors to consider Will 2016 be 2007 Redux? For many who believe that the US economy is really strengthening and can once again lead the rest of the world to more extensive recoveries, this may seem a bit odd.

Yet there are combined factors from many areas we have been focused on since the early part of last year which are less than constructive for the global economy and equity markets. We suggest a read if you have not done so already.

We pointed out in December that in the face of another likely Santa Claus Rally this was not an actionable view during the year-end equities rally. Yet it was (and remains) important background to utilize in 2016. This is much like our major late 2006 perspective on Smooth Rebalancing? …or… The Crash of ‘07? (even though the actual crash was deferred into 2008.)

▪ The market responses to all of that strong US economic data Friday reinforces the concerns about the overall global economic performance into the balance of 2016. Rather than simply looking at how the data is progressing, at times it is important to ask what the markets are telling us in their own right. US equities that finish the week under pressure in spite of strong data are a classical sign of a bear market shaking off near term positive data to reflect the overall trend. Possibly even more interesting is the US govvies finishing the week three-eighths of a point higher in the face of the sort of data that would normally knock them down. And that is also up near a three month weekly Closing high.

That just doesn’t make any sense on the short-term view, unless longer term instincts took over the trend on Friday. And that also points up the foreign exchange anomaly of the US Dollar Index rallying on that stronger data in spite of weaker equities performance. The idea that the stronger data might leave some feeling the Fed will indeed be within its rights to raise rates again sooner than not does not fit with the govvies strength.

It is possible that the foreign exchange is simply trading off the data and ignoring the message from the equities and govvies. Yet the other possibility os that there will indeed still be more weakness in the global economy, and it will typically affect other countries more than the still resilient (if not outright bullish) US economy. Under that scenario the equities can weaken while govvies strengthen, yet the greater weakness elsewhere will leave the US dollar a ‘haven’ currency that strengthens in spite of equities weakness.

▪ As we have anticipated for a while and noted more pointedly on the recent equities weakness in spite of the still quite accommodative central bank positions, what we are now seeing is the denouement of the extended multi-year central bank efforts to rescue economies that climaxed in the recent US equities rally. That was on display once again in last week’s still very accommodative Bank of England press conference after the very predictable ‘no change’ in its 0.50% base rate. The BoE pointed out the rightful nature of its caution due to the likely economic drags already apparent prior to the June 23rd UK referendum on European Union membership.

Yet that does not explain the overall weakness of the other developed economies in spite the occasional bits of stronger economic data. Once again we reference last Wednesday morning’s OECD Composite Leading Indicators (see above.) The UK referendum might be weighing on their economy, yet does nothing to explain the weakness of the other developed economies that now seems to be infecting previously more upbeat Europe.

And the core reason for that weakness after so much central bank rate accommodation and massive Quantitative Easing remains the same, and has little chance of reversing in the near term. Without essential assistance from structural reforms from the political class, all of the major central bank efforts may be for naught. As emphasized ever since our February 9th Fear & Loathing in Marketland post:

The next financial crisis will occur when the investment and portfolio management community (and ultimately the investing public) realizes that the central banks alone cannot restore the robust growth from prior to the 2008-2009 financial crisis.

▪ We refer you to the Market Observations below Thursday morning’s Global View TrendView video analysis (updated early last Friday prior to the important US economic data) for all of the technical trend Evolutionary Trend View and specific ‘macro’ background for each market as well as the most recent general ‘macro’ observations prior to the additional insights above in the earlier section of Thursday morning’s post.

The extensive analysis of the broader ‘macro’ background in previous posts has already explored all of the reasons the equities might be at the top prior to a much more major bear phase, and we refer you back to those for that insight.

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

The post 2016/05/15 TrendView VIDEO: Special 3 – Weekend appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.