2015/12/08 Commentary: Will 2016 be 2007 Redux? (late)

© 2015 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Tuesday, December 8, 2015

Commentary: Will 2016 be 2007 Redux?

They say that the market never repeats exactly, but it rhymes. While we cannot see any reason 2016 will be the start of anything quite so bad as what transpired out of 2007 into 2008, there are good reasons to be skeptical of the equities. That goes along with it likely being another year that frustrates the Bond Cassandras. The latter is not much of a speculation, and the bond skeptics have been wrong from the time the US economic recovery began back in 2010. Yet the equities have defied multiple stumbling blocks to climb the proverbial wall of worry for the past six years.

They say that the market never repeats exactly, but it rhymes. While we cannot see any reason 2016 will be the start of anything quite so bad as what transpired out of 2007 into 2008, there are good reasons to be skeptical of the equities. That goes along with it likely being another year that frustrates the Bond Cassandras. The latter is not much of a speculation, and the bond skeptics have been wrong from the time the US economic recovery began back in 2010. Yet the equities have defied multiple stumbling blocks to climb the proverbial wall of worry for the past six years.

That included shaking off the rather scary reactions in 2010 (including the US debt default and euro crisis) and again late last year (Ebola epidemic) into last summer (Chinese weakness and currency adjustments.) Yet here sits the S&P 500 within 3.0%(+/-) of its May all-time high. So while we are indeed negative on the equities (and friendly the primary government bond markets) into next year, there remain good reasons to respect the bull until after the first part of January. After that the range of factors we review below will most likely make for more challenging US and global economies and equity markets.

Yet for right now there is a Santa versus Satan scenario playing out. And the timing of each influence reinforces the suspicion that the bulls still have some time prior to the darker aspects holding sway over the markets. There have been very good recent examples of how any downside volatility can be contained in the near term.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the extended trend assessment as well.

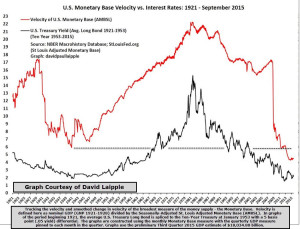

They say the devil is in the details. Mario Draghi certainly got some tutelage on that point last Thursday; as did the folks who were overly assumptive about what he was going to communicate at the ECB’s post-rate decision press conference about just how far he was prepared to accelerate the ECB’s already substantial Quantitative Easing (QE) program. Yet the real issues which might still bedevil the global economy and equity markets go far beyond the temporary disappointment with the pace of any particular central bank’s QE program or interest rate decision. That is why we began with the most current graph of the Velocity of the US Monetary Base.

As we have noted in previous analysis, in spite of the Brobdingnagian growth of the Fed’s balance sheet, this remains stuck below the worst levels seen during the Great Depression. We will revisit the stubborn reasons for that below. Suffice to say for now that it is why the US economy which may be among the strongest now still feels sluggish enough to be concerned about the likely 25 basis point FOMC rate hike this month.

Santa versus Satan

And yet, prospects for equities bears to benefit markedly in the near term look fairly dim due to a solid seasonal influence: Santa! As our regular readers know, we hesitate to call this the Santa Claus rally, because it really doesn’t have much to with the jolly old guy in the red suit. It is actually a ‘Santa Portfolio Manager Rally’ based on year-end portfolio window dressing during any middling-to-good year. For our full view on that, see last year’s Santa is already in town (redux) post. (Check out the parody at the end.)

In the battle between Santa and Satan, seasonal cheer has prevailed of late, and that is likely to continue from now through the end of the year. There is also reason to believe it will likely extend at least just a bit beyond that. That is because even years that have seen equities top for a larger downdraft have tended to benefit from fresh investment funds flowing in early January. Yet our extended perspective is the Devil will have his due. Developed economies and equity markets are far more vulnerable than the powers-that-be would like the masses and investment classes to believe.

In spite of all the good reasons for that explored below, the potential timing for any substantial equities selloff must be left to the actual technical failure signs. Even out of 2006 into 2007, the weakness of the underlying fundamentals did not begin to manifest real technical weakness until the August 2007 interbank lending problems. Traders had to learn to ‘love the bubble’ (as we advised through the first half of the year’s technical resilience) until the trend was really ready to favor the downside. However, those reasons for our skepticism are broad and deep, and the analysis below will incrementally clarify why the developed economies are not likely to perform in 2016.

OECD Trade Fade

After the strong early November US Employment report it was a fairly striking to see the OECD (Organization for Economic Cooperation and Development) Economic Outlook and Interim Economic Outlook the following Monday morning (November 9th.) The reason it includes the interim view as well is the incorporation of monthly Composite Leading Indicators (CLI) into this major semi-annual assessment. (The next CLI is released this morning was also still negative: see this morning’s post for more details.) It was quite downbeat, mirroring the slippage into atypical negative outlooks in all of its recent monthly CLI.

And two areas which seem most crucial to the anticipation out of 2015 into at least the early part of 2016 are economic weaknesses we have noted previous. The first is the telling sharp contraction in international trade. The second is the political class’ lack of desire or ability (take your pick) to provide the structural reforms necessary to complement the previous and ongoing massive Quantitative Easing programs of so many central banks.

Especially of note is the slideshow (enlarge to full screen) and the video of the Outlook presentation. Of particular interest in the press conference video discussion by Secretary General Angel Gurria and others is the focus from approximately 03:00 on the extreme weakness of global trade (we have noted previous), and (from 05:15) the fact that structural reform we have been so focused on all year is the only policy lever left after monetary and fiscal tools have been mostly exhausted.

That is increasingly important in the context of the significantly diminished global trading volumes. Global trade that had been growing slowly over the past few years now it seems to have gone completely stagnant, growing only 2.00% in 2015. The rule of thumb is that trade grows at double the rate of global economic growth. And here’s the rub:

Over the past 50 years there were only five years where trade growth was 2.00% or less. Each of those coincided with a marked downturn in global growth. 2016 may turn out to be the exception, but the historic context is not propitious, especially as future growth is expected to be subdued. Even the extended outlook into 2017 and 2018 is not very strong. And that is the sort of thing on which businesses base investment and hiring decisions. There is also little chance that the political class in the US will engage in any constructive compromise on badly needed structural reforms into an election year.

Corporate Savings Glut

This lack of corporate confidence plays into structural influences as well as some cyclical factors. Yet the former are more troubling from the standpoint of whether any central bank raising interest rates will have much impact encouraging higher inflation. There was an excellent analysis from the Financial Times’ Chief Economics Commentator Martin Wolf on The corporate surpluses are contributing to the savings glut. For those of you without a Financial Times subscription, the PDF version is available on our site. Yet we encourage everyone not already signed up to try an FT subscription. I consider it the finest global daily for both reportage and analysis (not to mention the cultural features.)

Wolf does a masterful job of explaining why the lack of corporate investment incentives is one of the most telling contributors to the depressingly low interest and inflation rates. The central banks can pump money all they want, yet until the primary investment operators are putting money to work there will be less hiring and growth. In the six major developed economies he cites, the corporate sector represents between half and two-thirds of gross investment. As he notes, “If investment is weak and profits strong (as at present), however, the corporate sector will, weirdly, become a net financier of the economy.

Makes sense if you think about it. Yet only in the context of the disincentives to invest that would normally leave corporations borrowers to finance expansion plans and hiring. While he notes this is also part of secular trends that began well before the 2008-2009 financial crisis, the lack of effective structural reforms (tax, regulation, environmental, labor market, etc.) have intensified these economic drags. He tellingly notes that so long as the corporate sector cannot invest its massive savings, the savings of the rest of the world are bound to have a low marginal value. In this regard, it really doesn’t matter that the Fed is trying to restore confidence things are ‘normal’ (more on that below) by putting the US base rate up off of emergency levels.

Depressing US Monetary Base Velocity

First of all, that US Monetary Base Velocity graph at the top of this postis very current, courtesy of our friend David Laipple. It is through the end of September, and the update to the one we led off with in our May 2nd Extended Perspective: Tail Risk is Back! post. That might be worth a read for the St. Louis Fed discussion of where inflation should be (31 percent) under classical circumstances with that sort of Fed balance sheet growth (along with some other interesting content.)

After all of the Fed’s Brobdingnagian balance sheet expansion through serial QE efforts, and all of the fiscal largesse flowing from the Obama administration and Congress, the Velocity of the US Monetary Base remains well below the slowest use of available funds during the Great Depression and the weak periods in front of World War II and the post-WWII recession. If things are so good why aren’t banks relending their funds, and why aren’t businesses putting their rather sizable balance sheets to work?

The Fed’s ‘Normalcy Bias’ problem

The Fed has a unique set of pressures. Its continued insistence there is some intrinsic value to pushing up the US base rate from the ZIRP (Zero Interest Rate Policy) lows before the end of 2015 still looks mindless to us. That is due to continued weakening of global, and even quite a bit of US, economic data. Even in anticipation of the looming FOMC rate increase, energy and commodity markets are weakening further. Less ‘free’ money means inventory liquidations, cancelled future investment plans and layoffs.

That said, the Fed is under intense political pressure over the issue of whether ZIRP has been around so long it has become counterproductive. We can further surmise that the Fed missed the window on raising the rate when it had the chance late last year into this spring on the previous improvement. Yet as Mario Draghi has repeatedly warned, without structural reform from the political class all the massive QE cannot possibly provide the sort of economic improvement that the public would desperately love to see.

Rather than castigate the political class for its crass aversion to addressing the underlying problems, the Fed is attempting to inspire confidence by providing a feeling that it is all getting back to ‘normal’. However, its repeated communications it is confident inflation will push up further any time now seem a like ‘whistling past the grave yard’ in the face of recent further commodity price declines.

‘Normalcy bias’ is a classic psychological syndrome where the impact of a pending disaster is not acknowledged due to the desire to think everything will be back to normal in spite of signs to the contrary.

One classical example is folks who remained in seats after a 1977 airplane crash in the Canary Islands. Still on the runway with the top of the cabin shorn off by the other jet that had already erupted into a fireball, only 70 of 496 passengers released their seat belts and managed to get to safety. The rest perished.

Researchers have found that in a large looming disaster only 15% or so of people can react instead of becoming frozen in place. Similar reaction (or lack of it) accompanied stark warnings before 2005’s Hurricane Katrina. Many people were assessing how it would compare to other storms they had weathered in place instead of seeking some sort of exit plan.

And in this case the Fed’s continued assertions that it expects “conditions to improve” consistent with the return to 2.00% inflation very soon seems more mindless across time. And even the US Employment reality is less impressive than headline US Non-farm Payrolls would suggest. As we have noted in much of our recent analysis, even other data sets in the US like Wholesale Sales (next release on Wednesday) and Retail Sales (next release on Friday) are more consistent with the ‘employment insecurity’ noted by North Island’s Glenn Hutchins in a recent television interview (see ‘Real US Employment Story’ below on all that.)

Maybe the Fed can convince some of the people that things are getting back to ‘normal’, even if it is the ‘new normal’. Yet if the ‘new normal’ is an environment not capable of sustaining higher levels of consumer activity in the home of conspicuous consumption six years into the ‘recovery’, it does not bode well for the global economy.

Still Not the Same as 2007

As far as similarities between this cycle and 2006 into 2007, we are not suggesting there will be a similar meltdown. There is just no equivalent exposure now as the completely convoluted, mismanaged combined Housing and Credit Bubble. Allowing the banks and securities firms to create a major pool of toxic Mortgage Backed Securities based on complex unpriceable formulae was a massive failure that will not be repeated this time.

Yet, as much as that was a failure of the political class and central bankers, the current lack of structural reforms from the political class only gets passing criticism from the same overseers. The US is among the worst offenders. Yet the claim that things are so partisan that no constructive compromise is possible doesn’t solve the fiscal and regulatory problems. And the regulatory and tax issues are significantly why banks are not lending and corporations are not investing.

Things are politically unbalanced in a way that does not seem solvable at present. And these unreasonable restraints and impediments to growth are a pernicious mirror image of the excessive regulatory and political lassitude into late 2006. That encouraged the imbalances that were behind quite a bit of the unraveling into 2007 and 2008.

Strong US Dollar & Weakening Earnings

The potential further strength of the US dollar is another issue which deserves review. While it would indeed be damaging if it were to rally, that is not really the issue. It has already strengthened enough to damage US manufacturing exports. The exact level of the export deficiency is less important than the fact it has already had an impact; and is further exacerbated by the impact on repatriated corporate earnings.

And some of the same things we have been noting (and more) were reviewed in typically incisive fashion by Richard Bernstein, CEO of Richard Bernstein Advisors LLC. We have been a fan of Bernstein for a while due to his in depth statistical correlations that go beyond classical fundamental analysis. His ability to reason through the prismatic aspects of how certain key measures relate to the evolution of the economic cycle has always been impressive, and was on display this morning.

He was a late-October guest on CNBC’s early morning Squawk Box, discussing the Fed in the context of the state of the economic cycle. While there is also classical friendly humorous disparagement between CBNC’s Joe Kernen and Steve Liesman, the exchange between Liesman and Bernstein is very interesting. Without giving it all away, Bernstein is keen to review why any increase in the US base rate might have an outsized impact in the context of slipping corporate earnings. It’s about the direction of the changes and not the historically low level of the nominal yields.

He also reviews one way in which the central banks may be trapped in a prison of their own devise, as the global credit bubble has created extensive over capacity (with the Fed as first and foremost culprit in our opinion.) That is a good reason inflation remains at troublingly low levels, along with the corporate savings glut reviewed above. He also understands that any Fed hike which further strengthens the US dollar exacerbates the problem for weakening US corporate earnings. Liesman makes a good, if already widely circulated, point that all of this has created an incredibly distorted economic and financial landscape; in many ways defying classical economic and statistical analysis.

That said, Bernstein seems to trump the conversation with a simple thought: It is probably not constructive to raise rates once earnings are under pressure. It’s a concise summary of quite a few of the key macro factors that the Fed and other central banks are grappling with at present. And while we still say this is a sideshow compared to the political class’ failure to provide meaningful structural reforms, he also notes that the US is already likely in an ‘earnings recession’.

Rather than restore confidence, that will likely only be exacerbated on several levels by any FOMC hike.

What About GDP Improvements?

Speaking of CNBC, ex-floor trader and full time CNBC CME floor correspondent and commentator Rick Santelli comes up with quite a few interesting, often iconoclastic observations. On the Wednesday before Thanksgiving he shared some interesting ideas on the trend of US GDP. What he demonstrates is that average US GDP for 2013 and 2014 was indeed up around 2.50%.

Yet based on the most current data from the forward looking Atlanta Fed estimates, 2015 average quarterly GDP might well drop back to 2.10%. That is based upon the most recent estimate for Q4 2015 having fallen down from 2.30% to 1.80%. Yet as he aptly notes, this is not a recession: there is indeed growth. Yet what is typically more important in assessing future growth is the direction and rate of change.

He notes the real issue is “how much horsepower all the (individual) economies put into the global economy.” Sounds an awful lot like OECD Secretary General Gurria’s concern over the overall weakening of global trade discussed above. While the OECD highlighting Europe as the leader would be alright with all else equal, if the US and some other major economies are weakening, can we count on Europe to lead the way higher?

Real US Employment Story

Getting back to what North Island Chairman Glenn Hutchins had to say about the reason for US GDP growth stagnating at no better than 2.0-2.5%, there is unfortunately no video clip or transcript of his CNBC appearance back on November 16th. The folks there thought it more important to memorialize his thoughts on countering chaos in the Middle East.

Yet we were watching that very closely, and there was a most interesting discussion on the state of the US middle class. In spite of all the hoopla from the Obama administration and their minions on regaining and exceeding all of the jobs lost during the financial crisis, the lower levels of actual earnings is hamstringing the US economy.

That is because at best the US middle class is only seeing its income increase by approximately that 2.0-2.5 percent per year. And the very astute Mr. Hutchins points out that you cannot have GDP outpace the available income of consumers; at least not on a sustained basis. He also notes the degree to which people are having to work harder to achieve even that modest gain, and are suffering from employment insecurity compared to previous economic recoveries.

This has led to what he describes as ‘Consumption Conservatism’: people no longer feel they should spend any extra money when they manage to get some. It should be banked against the potential for some further distress coming along at any time. The very weak nature of the current recovery has in fact gone a long way toward ‘curing’ Americans of their longstanding ‘conspicuous consumption’ habit. Striking.

And it would seem that is behind the lack of any robust manifestation of the anticipated spending from the energy price drop ‘dividend.’ And those have been serial energy price slides. What is also striking is that this seems to be happening in the UK as well, based upon their recent high real earnings growth versus weak Black Friday sales volumes.

That is probably related to the changing nature of employment in the developed world, highlighted by the radical shift in the complexion of US employment. What we have here is a serious dislocation between the sheer number of jobs versus any real return to prosperity.

Stockman’s View

For further thoughts and some data on this we turn to ex-Reagan Office of Management and Budget Director David Stockman. While not its inventor, he was surely one of the high priests of Voodoo Economics. That was the derisive nickname for the major Reagan administration supply-side tax reforms that many mistakenly said would never work.

Stockman has long been a bit of a Cassandra. His ideas on the serial missteps of central banks are as well-known as they are radical. He views a lot of the incremental steps of the global central banks, and especially the Federal Reserve, to continually liquefy what he views as a totally bankrupt system as a perversion of true free market capitalism.

That said, his research is very good. His sporadic review of the hollowing out of the US middle class that began well before the 2008-2009 Crisis are some of his better analyses. While the one we reference here is a bit dated, the trends remain substantially same. And they are likely to continue until that badly needed structural reform actually passes through the US government and is implemented.

That is the significant shift from highly paid skilled jobs into lower skilled service jobs. His mid-2014 Contra Corner post Jobs Friday: What The Bubblevision Revelers Missed sums up the trends in both discussion and a few very interesting graphs. He also indulges his penchant for anti-central bank policy rants, to wit, “…6-years of ZIRP have left the world’s financial system booby-trapped with tottering pyramids of debt and rampant carry trades and financial speculations.”

Yet beyond that the bottom line is that the US has substantially lost many ‘Goods Producing Economy’ jobs that earned approximately $46,000 per year. There were almost 25 million of them back before the 2000 Dot.Com Bust and attendant economic contraction. There were still almost 22 million of those jobs at the end of 2007. Yet in May of 2014, four-and-a-half years into the Obama-Bernanke recovery there were only 19 million, up marginally from a low of 17.7 million in January of 2010.

And the picture for the broader Breadwinner Economy (similar income level) including various white collar jobs is not much better. Recovering back near the Early 2001 high of 71.7 million between mid-2007 and early 2008. It had only recovered to 68.5 million in mid-2014 from a recession low of roughly 65 million.

So where did all of those folks who lost those jobs go? Chances are some goodly number of them ended up needing to join what Stockman calls the Bread and Circuses Economy. This is the broad range of jobs serving the hospitality industry, yet which only earn approximately $25,000 per year.

There has also been steady growth even during the contractions in the HES Complex economy: Health, Education and Social Services. Yet, as Stockman points out, even though these jobs average $35,000 per year, they are fiscally dependent industries. And when you strip out the last two categories from the first two, the US has not regained the jobs lost in the crisis. It fits right in with Glenn Hutchins’ observations on the newfound middle class ‘Consumption Conservatism.’

That is important, because all of the talk in the financial press about job ‘gains’ over the many years since the crisis are essentially not new jobs. And given the much lower income levels that many of them represent on average, this does not seem to be a formula for continued growth into the foreseeable future.

It will more so be a test of just how well the US and global economy can perform once the central banks begin to withdraw the accommodation that has been so critical to maintain confidence and even relatively subdued levels of growth.

Conclusion

Top line of the conclusion is that there is a confluence of factors that are less propitious for the continued growth of the global economy than the powers-that-be would like the masses and investment classes to believe. The bottom line is that all of the talk of returning the world to levels of inflation that speak of the need to invest have put the cart far out in front of the horse.

It is the enlightened policies from structural reforms that should be encouraging investment and hiring, which in turn would create some real inflation. The central banks’ attempts to give the illusion of health through manufacturing some sheer monetary inflation during a sustained weak economic period is the real Voodoo Economics. It also appears that it is failing miserably, as indicated by weak commodity prices and lackluster employment (compared to an normal recovery from a deep recession.)

This is why 2016 may well be 2007 redux. Lax policies back then led to a monstrous Credit and Housing Bubble that had no near term remedy. Over regulation and taxation may create a similar dislocation into next year. And the central banks massive accommodation programs affording the political the largesse to ignore the need for reforms is making the necessary adjustment almost impossible to achieve.

Why would politicians take on the risk of painful compromises when everything is going along just fine? And after already bloating their balance sheets, the central banks will not be well positioned to provide necessary support as the Fed did back in early 2009. We have asked before, and dare to inquire again…

Who will ‘ride to the rescue’ if the central banks are viewed as not capable of rectifying the situation?

The COMMENTARY Extended Trend Assessment is accessible below.

The post 2015/12/08 Commentary: Will 2016 be 2007 Redux? (late) appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.